Climate Income - How powerful climate policy can address the cost of living.

By James Collis - James Collis is the Chair at Citizens’ Climate Europe and a Member of the EU Climate Change Expert Group for ETS2 Implementation. He is also PPC for Broxtowe Constituency

The next UK government must address the cost of living crisis. It’s also clear from public data that the climate crisis is an ongoing concern for 75%. Now there is the opportunity to kill multiple birds with one stone. The latest developments in the EU Green Deal are contributing to international momentum on the subject of carbon pricing. If the UK wants a closer relationship with Europe, aligning on this key environmental policy offers a number of additional social and economic benefits.

Carbon pricing, also known as carbon taxation, is overwhelmingly the fastest and most effective tool to cut greenhouse gas emissions. No one claims carbon pricing solves everything, other policies are needed, just that it's the most important thing to do. Carbon pricing is a cornerstone of the EU Green Deal and improves the effectiveness of all other climate policies. The World Bank tracks international carbon pricing development both in terms of coverage and price level, i.e. how many emissions are covered and at what price.

Currently the UK prices 40% of carbon via the Emissions Trading Scheme (ETS) which applies to large scale industry (and is almost invisible to consumers). The UK carbon price floor legislation adds strength and has been effective in dramatically reducing coal from UK electricity production. The EU is extending the ETS to Buildings and Road Transport (ETS2) with further expansion under discussion. The same approach in the UK would increase carbon pricing coverage to over 80% and have a direct impact on all households.

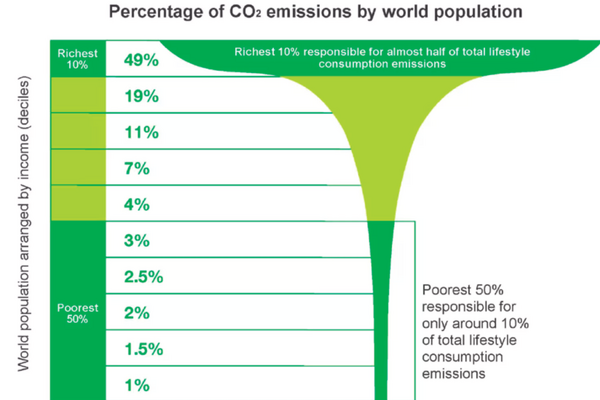

Although most poor and middle income families use much less energy than the richest, it’s a higher proportion of their income. This form of taxation is inherently regressive, hurting the poor more than the rich. Climate Income, where the proceeds of the tax are given back equally to people, makes the vast majority of poor families and most middle income families better off. Making carbon tax popular and progressive in this way is well understood.

The challenges for politicians in implementing Climate Income are that the public are wary that “tax” means they will likely be worse off, and industry is concerned about international trade competitiveness. The information on these first two issues has improved considerably, though there remains pressure from the fossil fuel lobby, which is still more powerful and better funded than the emerging green industry.

The recent OECD report International Attitudes Toward Climate Policies surveyed 40,000 citizens from 20 countries. It found that people want to know that the policy works, is fair, and how it will affect them. The report showed that 5 minute videos can build public support, showing fairness by redistributing revenue equally protects poorer households. For the UK, confidence in public support for Climate Income is reinforced by the Scottish Climate Assembly with 77% support for this specific policy.

Industry fears about “carbon leakage”, when trade and jobs are lost to companies in other countries with lower pollution costs, have often been highlighted as an economic risk. The EU has now taken on this issue directly with the Carbon Border Adjustment Mechanism (CBAM). It is prompting action in relation to carbon pricing from the US, China and India. Evidence from US industry implies that the UK not only has nothing to fear, but in fact has much to be gained. Energy intensive UK industry is highly competitive and is effectively leaving money on the table by not pricing international emissions.

Whatever the UK’s desired trading relationship with Europe, there are proven examples of Climate Income. Canada and the UK today have similar trading structures with the EU. Canada introduced The Greenhouse Gas Pollution Pricing Act in 2019 rebating 90% to households. Expert consensus is growing that this is the best solution for Canada. Switzerland is in the European Free Trade Agreement and outside the EU. In addition to an aligned EU ETS, as the UK has, Switzerland prices domestic fuel at €120 with 67% returned to households. Austria is in the EU, in the Customs Union and the Euro Zone. Specifically in preparation for the ETS2 Austria introduced KlimaBonus (Climate Bonus) returning 100% to households.

Being outside the EU may have advantages, EU member states have concerns about legislative complexity and price volatility. Especially when simpler alternatives like a national carbon price are encouraged by Sweden and considered in Germany, where civic society is demanding the government deliver the manifesto promise for KlimaGeld (Climate Money). The UK carbon price floor legislation has the potential to provide harmonised and less volatile pricing than either the ETS or ETS2. Predictability is very helpful to the longer term planning and certainty needs of industry highlighted in the FASTER principles for successful carbon pricing.

Climate Income is a zero cost policy that addresses two of the top concerns of the public. With the prevailing international winds blowing in support, it does more to reduce emissions than anything else. It’s good for international trade, the economy and jobs. Most households are better off. And it’s endorsed through the biggest statement by economists ever, including every living Nobel Laureate Economist. Time to act on the advice of experts.

N.B. This article argues for a similar policy advocated by the Young Liberal Democrats described as “A Progressive Carbon Tax” in their Policy Book from 2021. There is an updated European Young Liberal (LYMEC) policy “6.11 The Adoption of C02 Taxes and Tariffs by the EU” in their 2024 Policy Book that shows further support.

James Collis is the Chair at Citizens’ Climate Europe and a Member of the EU Climate Change Expert Group for ETS2 Implementation. - Read More about James here